Websites & Marketing For Success

We’re Currently Taking On New Clients

Let’s get your online presence ready to make the most of what has to offer.

GET STARTEDChuck and his team was a great find !! New website, Google ads, and SEO. We have closed leads from entry to closing table in 47 days! Customer service is on spot as well. Highly recommend 714Web.

— Tracy King

We've had a really incredible experience with these guys. The branding and web package I got from them far exceeded my expectations. Their ability to see exactly who I am as a business owner and then put that into a compelling design was kind of unbelievable.

— Jeff Walker

We have worked with Chuck Peters and his team for the last 3 years on numerous websites. We have a varying array of businesses that each require specific needs for their online presence. 714Web captured all of the key elements we desired in a website plus quite a few more at the suggestion of the 714Web team. Like most companies today, I would not call our company overly tech savvy and we depend on vendors like 714Web for outstanding website design and functionality. Chuck and his team keep up with the ever changing technical enhancements needed to keep our websites relevant and optimized. 714Web is always there to help us with any of our other electronic media including our social media platforms and eliciting great engagement on those platforms as well. I would happily recommend Chuck Peters and the 714Web team for your company as well.

— Tom Horne

Owner, Local Goat American Restaurant, LocalGoatPF.com | Former Vice President of Operations, Diverse Concepts

I love working with 714Web! They have an amazing team and always bring new and exciting ideas to the table. They keep me informed of the latest trends and how to bring websites to life. They are easy to work with and always accommodating with schedule conflicts and last-minute changes.

— Christina Center

Marketing Director, Diverse Concepts Limited Restaurant Group, BullfishGrill.com

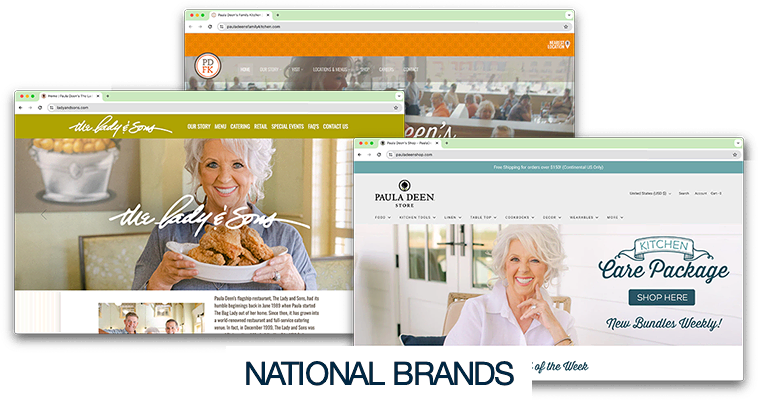

Chuck and his team made adding E-Commerce to our distribution warehouse a breeze with Shopify. He patiently walked us through each step and worked with our inventory software team through the whole integration. We count its huge success to Chuck and his team and look forward to growing our Paula Deen Stores business more in the future!

— Nicole Gotshall

VP of Retail Operations, PaulaDeenShop.com